Philippines – Sulu Sea

Sunda Energy PLC has a 37.5% non-operated working interest in two licenses in the south-west part of Sulu Sea, offshore Philippines.

Highlights

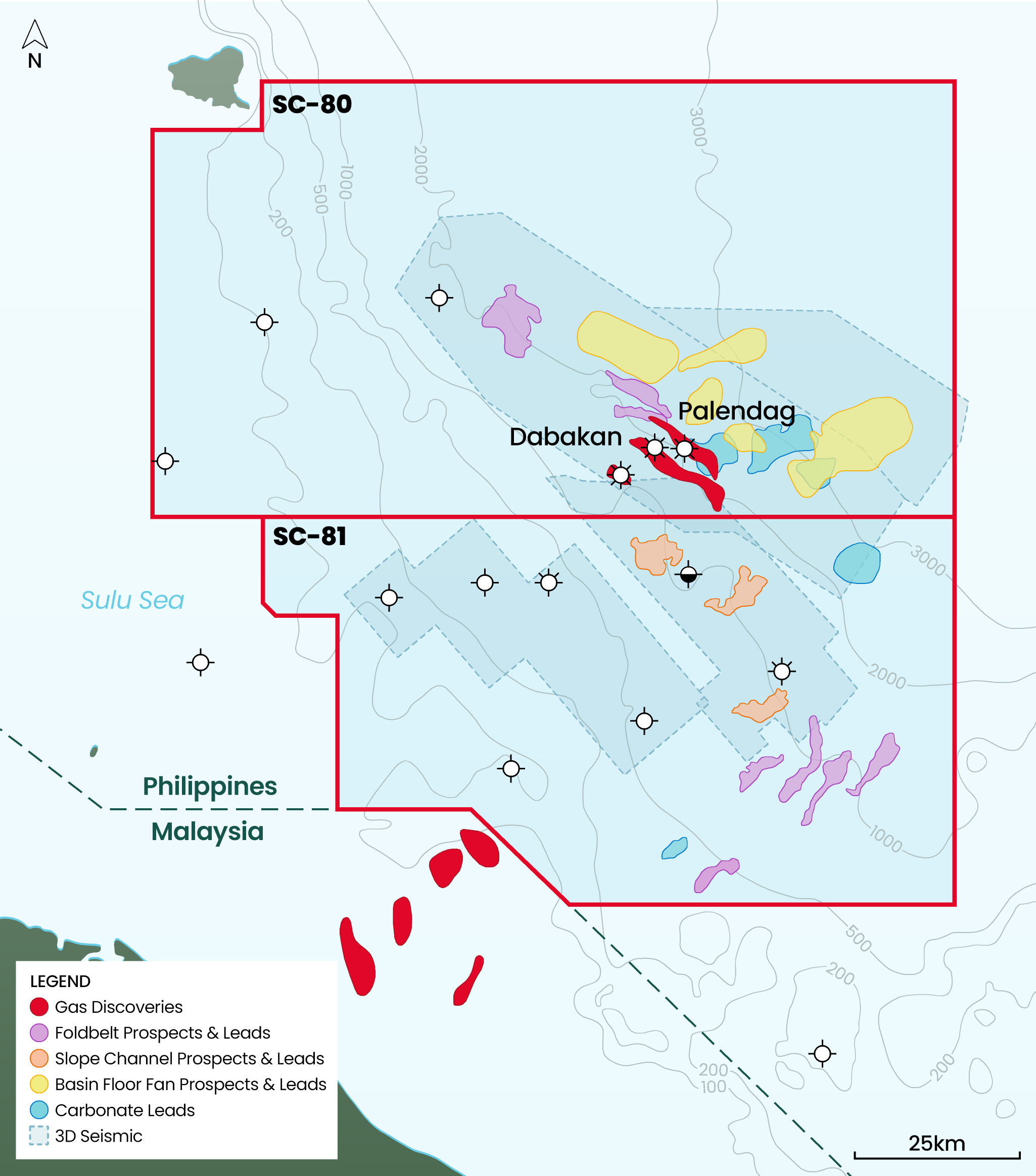

- Two highly-prospective licence blocks, SC-80 and SC-81, in the south-west part of the Sulu Sea, offshore the Philippines.

- Sunda’s team has extensive knowledge of the fields and the jurisdiction.

- Favourable fiscal terms across both blocks.

- SC-80 – estimated combined 1C Contingent Gas Resources of 1811-2212 Bcf, 2C Contingent Gas Resources of 4701-5742 Bcf and 3C Contingent Gas Resources of 1,3171-2,5042 Bcf.

- SC-80 – estimated Pmean Prospect Gas Resources of 10,088 Bcf2.

- SC-81 – prospective trend is covered by several 3D seismic surveys with a number of seismic anomaly-supported prospects and leads.

Blocks awarded in October 2025, have the following working interests:

| Triangle Energy Limited | 37.5% |

| Sunda | 37.5% |

| PXP Energy Corporation | 12.5% |

| The Philodrill Corporation | 12.5% |

Service Contract SC-80 covers much of the area of a former Service Contract (SC 56), where key members of the Sunda team gained extensive knowledge, working with a previous operator (Mitra Energy). ExxonMobil farmed in and drilled four exploration wells in the deepwater fold belt play in 2009-2010, finding two significant gas fields. These wells included Dabakan-1 (75m net pay) and Palendag-1 (47m net pay). The Babendil-1 well (39m net pay) was also a minor gas discovery.

The two fields have estimated combined 1C Contingent Gas Resources of 221 Bcf2, 2C Contingent Gas Resources of 574 Bcf2 and 3C Contingent Gas Resources of 2,504 Bcf2, based on a Competent Person’s Report (“CPR”) produced by Mitra Energy Inc. in 2015. A later CPR published by Jadestone Energy in 2018 estimated combined 1C Contingent Gas Resources of 181 Bcf, 2C Contingent Gas Resources of 470 Bcf and 3C Contingent Gas Resources of 1,319 Bcf1.

Service Contract SC-81 lies adjacent and to the south of SC-80 and encompasses both a slope clastic play and a shallow water shelf play.

On the slope trend in SC-81, two wells have demonstrated the presence of hydrocarbons: Wildebeest-1 recovered oil samples from thin sands and Lumba Lumba-1 encountered significant hydrocarbon shows but was abandoned early due to anomalous pressures.

Sunda and partners consider that these earlier wells missed key target areas, including prospective areas within SC-80 with associated seismic amplitude anomalies, which neither well targeted.

Most of the prospective trend on the slope is covered by a 750km2 3D survey, acquired in 2007, on which several seismic anomaly-supported prospects and leads have been identified.

Several carbonate reef buildups have also been identified, which represent additional potential exploration targets; such targets have proven highly prospective elsewhere offshore Borneo and globally.

The geological environment of the two new Service Contracts, the presence of extensive 3D seismic data, and good calibration from a number of wells, makes this area ideal for the deployment of modern seismic imaging technologies.

The significant earlier investments made by ExxonMobil, and later TOTAL, in this data, creates a good opportunity for Sunda and its joint venture partners to deploy special processing techniques to properly delineate the gas discoveries and further de-risk the material exploration prospectivity.

If successful, this low-cost approach should reveal high impact appraisal and exploration targets for farmout and future drilling.

| Prospect | Low | Best | High | Pmean | POSg |

|---|---|---|---|---|---|

| Dabakan Extension | 190 | 282 | 362 | 288 | 36% |

| Palendag Extension | 63 | 143 | 248 | 151 | 32% |

| Luntang | 317 | 509 | 762 | 528 | 21% |

| Halcon | 1,533 | 5,783 | 13,138 | 6,735 | 21% |

| Samat | 958 | 2,260 | 3,961 | 2,386 | 16% |

| TOTAL | 9,988 |

| Prospect | Low | Best | High | Pmean | POSg |

|---|---|---|---|---|---|

| Dabakan Extension | 1.7 | 3.4 | 4.7 | 3.5 | 36% |

| Palendag Extension | 1.0 | 2.4 | 4.3 | 2.7 | 32% |

| Luntang | 5.3 | 9.4 | 15.5 | 10.1 | 21% |

| Halcon | 33.0 | 136.0 | 344.0 | 169.0 | 21% |

| Samat | 21.0 | 54.0 | 109.0 | 62.0 | 16% |

| TOTAL | 247.3 |

1 Competent Person’s Report (“P3645 – YE2017 Reserves & Resources Report for Australia, Vietnam and Philippines Asset”), published by Jadestone Energy in 2018 as part of Admission Document. Results in accordance with the March 2007 SPE/WPC/AAPG/SPEE Petroleum Resources Management System (“PRMS”) as the standard for classification and reporting.

2 Competent Person’s Report: Resources Assessment of the Assets of Mitra Energy Inc., 2015. Results in accordance with the standards set out in the Canadian Oil and Gas Evaluation Handbook (“COGEH”) prepared jointly by the Society of Petroleum Evaluation Engineers (SPE) and the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”), and the Petroleum Resources and Reserves definitions contained in Canadian National Instrument 51-101 (NI 51-101) Standards of Disclosure for Oil and Gas Activities.